Verification of Payee (VoP)

Overview

From 9 October 2025, new EU rules under the Instant Payments Regulation (EU 2024/886) will apply to all euro-denominated SEPA credit transfers. These rules aim to increase payment safety by ensuring that payee details are accurate.

Under the regulation, Payment Initiation Service Providers (PISPs) must offer a Verification of Payee (VoP) service:

- Merchant payments : where the payee details are pre-populated (e.g. checkout flows, merchant payouts).

- Peer-to-Peer (P2P) and Bulk payments : where the payer provides the payee details (e.g. payroll, expenses, family transfers).

How it Works

VoP is enforced differently depending on the use-case:

-

Merchant (pre-populated payee details)

You have a contractual relationship with the payee (merchant, partner, supplier). The payee’s details must be verified upfront during application beneficiary onboarding . Payment authorisations will fail if the details don’t match. -

P2P & Bulk (payer-provided payee details)

You have a relationship with the payer, but not necessarily the payee. A VoP check is performed when the payer adds a beneficiary. The PSU must be shown the check result and decide whether to proceed. Please note that business payers may choose to opt out of the VoP check for bulk payments.

Flows

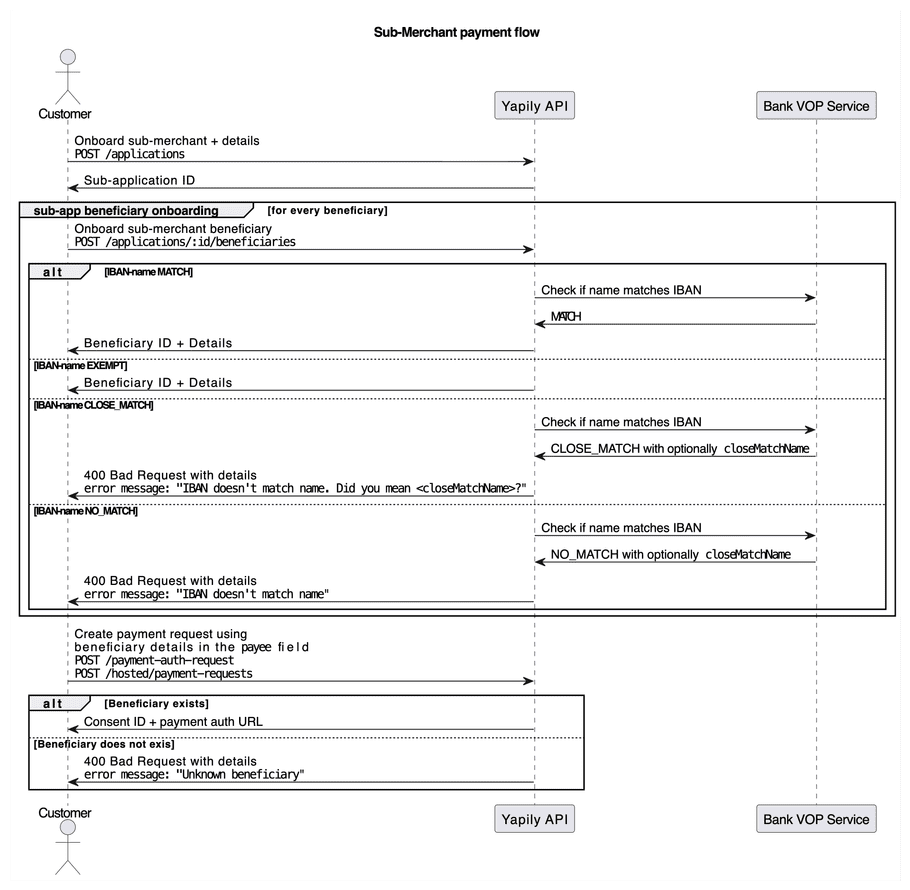

Merchant (Pre-Populated Payee)

- Add payee via Application Beneficiary API .

- Yapily performs a VoP check .

- If match/exempt → beneficiary verified.

- If no match → payment authorisations using this beneficiary will fail .

Flow diagram:

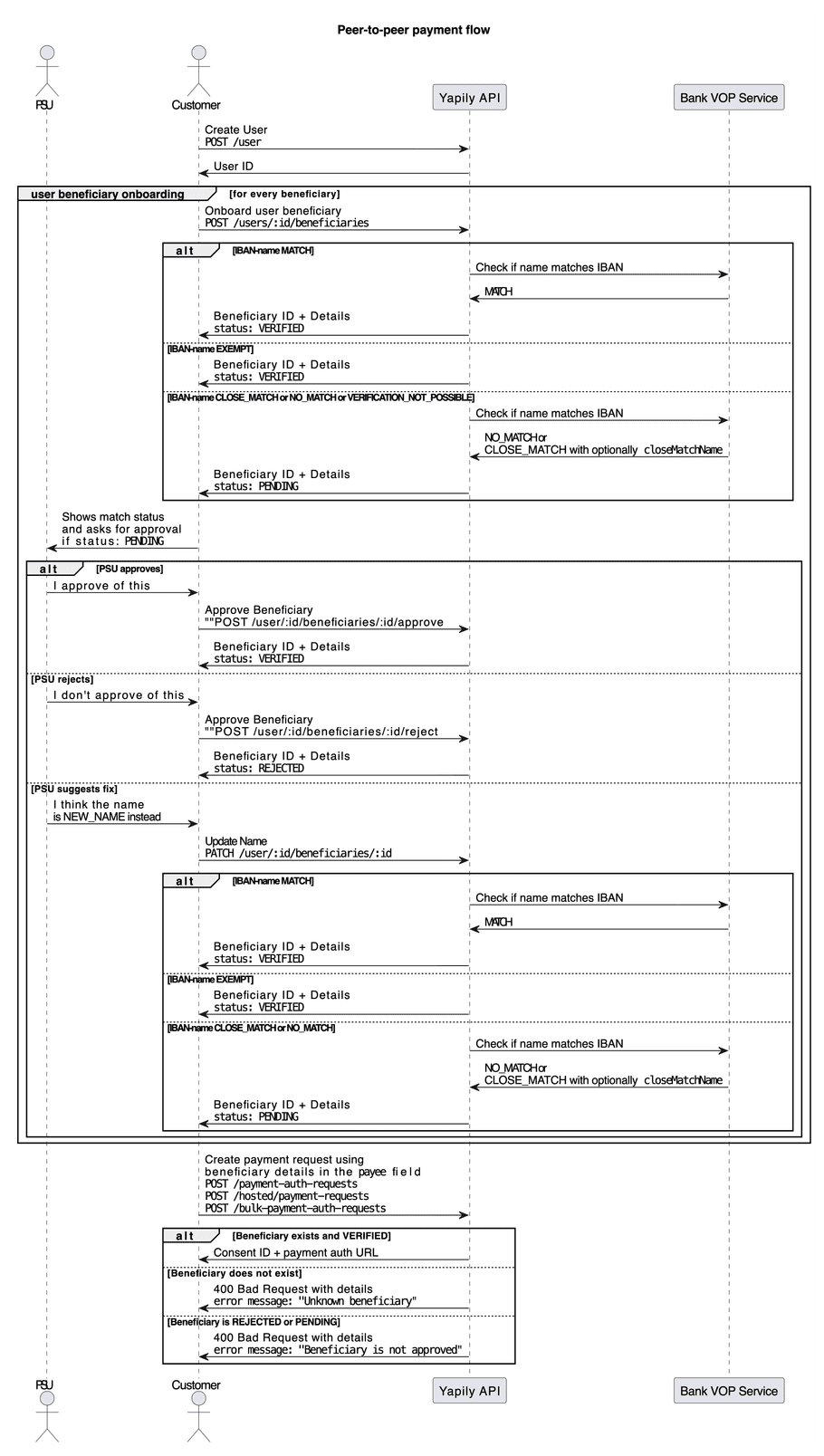

P2P & Bulk (User-Entered Payee)

- Add payee via User Beneficiary API .

- Yapily performs a VoP check .

- If match/exempt → beneficiary verified, no further PSU action needed.

- If close match / no match / verification not possible → show mandatory PSU messaging , capture approve/reject decision.

Flow diagram:

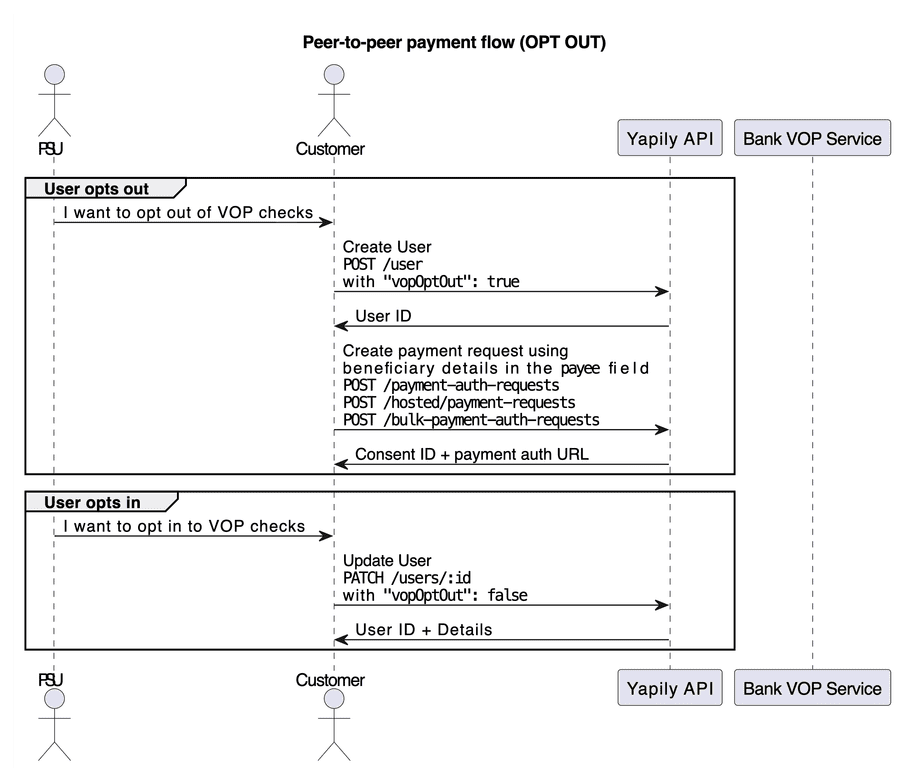

Bulk (Opt-In / Opt-Out for Bulk Payments)

- Business PSUs may opt out of VoP for bulk payments.

- Note: Customers must be shown prescribed wording when presenting the opt out.

- You must allow your business customers to opt back in to VoP at any time.

Flow diagram:

Required Steps

Merchant

- Implement Application Management and add payees via Application Beneficiary API.

- Ensure Payee Name & IBAN match exactly.

- Ensure PSU-facing screens display the exact verified name.

- You can find our PIS UX guidelines here.

P2P & Bulk

- Create a User for each payer.

- Add User Beneficiary with Account Holder Name & IBAN.

- Display the result of the VoP check with prescribed wording .

- Capture PSU’s decision with Approve or Reject .

- Payments can only be initiated against approved beneficiaries.

UX Guidelines

Merchant

- Show the verified payee name exactly as stored (no abbreviations).

- PSU sees payee details as part of consent but does not need to approve/reject.

- Errors/mismatches block payments — you should fail gracefully and provide retry instructions.

P2P & Bulk

- Show PSU the VoP check result using the prescribed wording .

- PSU must be able to approve or reject payees.

- Approvals must be stored against the beneficiary before payments proceed.

- Bulk Business users who opted out from VoP check, must be able to opt back in to VoP at any time if they choose to do so

Example: Adding a Beneficiary

Merchant (Application Beneficiary API)

POST /applications/{applicationId}/beneficiaries

Content-Type: application/json

{

"name": "Robert A",

"accountIdentifier":

{

"type": "IBAN",

"identification": "DE12345123451234512345123"

}

}Successful Response

{

"beneficiaryId": "e7b7636d-a041-4013-8a1b-34dc85b7d341",

"details": {

"name": "Robert A",

"accountIdentifier": {

"type": "IBAN",

"identification": "DE12345123451234512345123"

}

}

}P2P (User Beneficiary API)

POST /users/{userId}/beneficiaries

Content-Type: application/json

{

"name": "Robert A",

"accountIdentifier": {

"type": "IBAN",

"identification": "DE89370400440532013000"

}

}Response with Close Match

{

"beneficiaryId": "e7b7636d-a041-4013-8a1b-34dc85b7d341",

"status": "PENDING",

"details": {

"name": "Robert A",

"match": {

"status": "CLOSE_MATCH",

"closeMatch": "Robert Albert"

},

"accountIdentifier": {

"type": "IBAN",

"identification": "DE12345123451234512345123"

}

}

}In this case, you must display the correct PSU messaging and capture their decision via the Approve or Reject endpoints.

For the complete list of endpoints, see the API Reference.

Communicating Results to PSUs

For P2P and Bulk use-cases, you must present results exactly as prescribed:

-

Match (Optional messaging)

“The name and account type you entered matches the details on the account.” -

Close Match

“The account name does not exactly match the details you have provided.

Account holder name:<ACTUAL NAME>

You provided:<USER INPUT>

Making a payment to this account may result in money being sent to the wrong person or business, and if you continue, you may have limited rights to a refund.” -

No Match

“The account name you are paying does not match the details you have provided.

Making a payment to this account may result in money being sent to the wrong person or business, and if you continue, you may have limited rights to a refund.” -

Verification not possible

“We cannot verify this bank account at this time. You may wish to confirm the details directly with the payee before continuing.

There is a risk your payment could go to the wrong person or business, and if you continue, you may have limited rights to a refund.” -

Opt Out (Bulk payments only)

“You are choosing to opt out of receiving verification of payee services.

This may result in payments being sent to the wrong person or business, and if you continue, you may have limited rights to claim a refund.”

Payment Flow Considerations

- Merchant : payment fails if payee not verified.

- P2P/Bulk : payment fails if payee not approved.

- Bulk : files containing unapproved payees will be rejected.

See API Reference for endpoints.

FAQs

Does VoP apply only to SEPA Instant?

No, VoP applies to both SEPA Instant and SEPA Credit transfers for payments made in EUR.

Is a VoP check made for every payment request?

No, checks occur when adding beneficiaries (not on each payment).

Do I need to show the verified name exactly?

Yes, the exact Account Holder Name must be shown; abbreviations or variations are not accepted.

Can beneficiaries be reused across applications or sub-applications?

No, beneficiaries must be created separately per application/sub-application.

Are there exemptions?

Yes. Payments to non-eurozone or non-EU countries are exempt until VoP becomes mandatory in those markets (by 9 July 2027).

Can customers opt out of VoP?

Yes, business customers may opt out for bulk payments. Single payments cannot be exempted.

What happens if a PSU tries to make a bulk payment that contains unapproved payees? Yapily will check the file to confirm that all payees are approved prior to initiating payment. If a bulk payment file contains unapproved payees, we will reject the payment and return a message specifying which payees need to be verified. Please note that this does not apply to PSUs that have opted out of VOP.

Next Steps

- Review your payment journeys and determine where VoP applies.

- Implement Application & Beneficiary Management .

- Integrate with Yapily’s Beneficiary APIs .

- Update your PSU-facing messaging in line with regulatory requirements.

- Test using our sandbox environments.