Payment status

Further reading on receiving payment status updates from an institution after executing a payment.

Introduction

After initiating a payment, its current status in the processing lifecycle can be monitored.

In order to provide the most comprehensive information on the payment status, but also to overcome limitations in what different institutions report, there are 2 types of status available.

How long does it take for a single transaction to settle?

Open Banking payments executed through Yapily send the payment instruction to the Institution.

As a result, the payment rails used by the Institution to execute the payment ultimately

determines how fast the payment settles.

- The Faster Payments Scheme (for Domestic Payments within the UK) : Normally, a Faster Payment arrives within minutes although sometimes they can take up to two hours. Where the recipient is a Faster Payments Participant Bank, they should generally be able to see the credit on their account within seconds and also be able to access the funds

- SEPA Credit Transfer (for Euro payments within SEPA countries) : SEPA Credit Transfer takes a maximum of one banking business day.

-

SEPA Credit Transfer Instant (for Euro payments within SEPA countries)

: SEPA Credit Transfer

Instant is available 24 hours a day, 365 days a year and there are no cut-off times. The

maximum execution time for a SCT Instant payment is 10 seconds, and the funds are immediately

available for the recipient. In order to facilitate these payments, there are often

charges associated with these payments averaging €0.002 per transaction but additional charges

by each

Institutionare usually also applied.

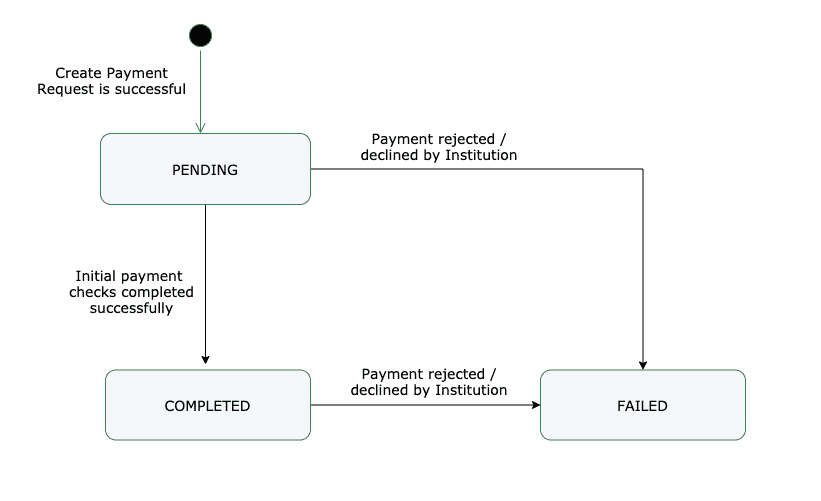

Initiation Status

status indicates whether the payment has been successfully initiated with the Institution and should be considered as the 'primary' status.

It may be set to one of the following values:

-

PENDINGwhen the initiation request is still being processed -

COMPLETEDwhen the initiation request has passed validation checks and been accepted by theInstitution. Settlement is expected to happen in due course (or according the the provided schedule for a Periodic or Scheduled payment) -

FAILEDwhen theInstitutionhas rejected the initiation request and the payment will not be processed further

You may wish to monitor the status of a payment until it has reached the COMPLETED or FAILED state by polling Get Payment Details

Note

Whilst unlikely, there may be an issue in the Institution processing of a payment after it has been accepted. In order to provide visibility of when this occurs, a payment initiation request that was COMPLETED may subsequently become FAILED.

Note

The status reports on payment initiation only and, as such, COMPLETED does not indicate that settlement has occurred. The isoStatus should be used (where available) to understand the status of payment processing and execution, including whether settlement has occurred to the payer or payee account.

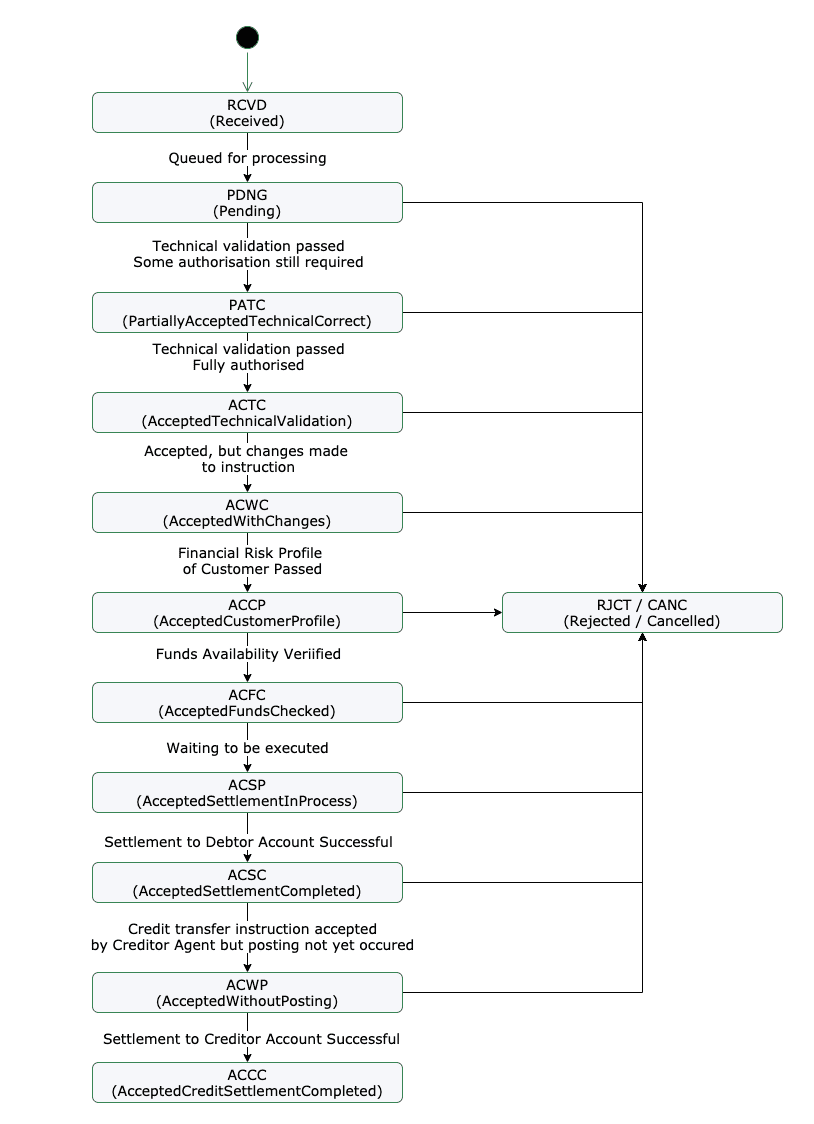

Processing & Execution Status

The isoStatus provides more detailed and extensive reporting on the payment status.

It's primary use is after a payment has been successfully initiated (i.e. status is COMPLETED) when the Institution will proceed with executing the payment. The isoStatus can be used to track the payment through its execution process through to final settlement to the payee's account.

Attention

Yapily cannot guarantee the provision or accuracy of the isoStatus. The reporting is limited within some Institutions and they may stop reporting at an intermediate state (e.g. ACTC) even though processing has continued.

Where the status is COMPLETED, but an issue is experienced with the payment, then this indicates that a problem has occurred with the Institution, who should be contacted for further investigation.

The code and associated name are reported using ISO20022 values, as summarised below.

| Code | Name | Description |

|---|---|---|

| ACSC | AcceptedSettlementCompleted | Settlement on the debtor’s account has been completed. |

| ACCC | AcceptedCreditSettlementCompleted | Settlement on the creditor's account has been completed. |

| ACCP | AcceptedCustomerProfile | Preceding checks of technical validation was successful. Customer profile check was also successful. |

| ACSP | AcceptedSettlementInProcess | All preceding checks such as technical validation and customer profile were successful and therefore the payment initiation has been accepted for execution. |

| ACTC | AcceptedTechnicalValidation | Authentication and syntactical and semantical validation are successful |

| ACWC | AcceptedWithChange | Instruction is accepted but a change will be made, such as date or remittance not sent. |

| ACWP | AcceptedWithoutPosting | Payment instruction included in the credit transfer is accepted without being posted to the creditor customer’s account. |

| ACFC | AcceptedFundsChecked | Pre-ceeding check of technical validation and customer profile was successful and an automatic funds check was positive . |

| RCVD | Received | Payment initiation has been received by the Institution. |

| PART | PartiallyAccepted | A number of transactions have been accepted, whereas another number of transactions have not yet achieved 'accepted' status. This code may be used only in case of bulk payments, where reporting is performed against the entire file. Yapily reports status against each transaction, so this status is not expected. |

| PATC | PartiallyAcceptedTechnicalCorrect | The payment initiation needs multiple authentications, where some but not yet all have been performed. Syntactical and semantical validations are successful. |

| PDNG | Pending | Payment initiation or individual transaction included in the payment initiation is pending. Further checks and status update will be performed. |

| RJCT | Rejected | Payment initiation or individual transaction included in the payment initiation has been rejected. |

| CANC | Cancelled | Payment initiation has been cancelled before execution |

Monitoring the Payment Status

Not all banks report all isoStatus as shown above, and typically we can see two main distinctions:

-

For UK banks

: Most of the banks report up to

ACSC. -

For EU banks

: Many banks will report up to

ACSC, but many others will stop reporting atACCP, specially (but not only) German banks such as DB, Commerzbank; several Italian banks; etc. In this scenario (EU Payments in general) the lowest common denominator is theACCPstatus.

Based on this logic, it is not always possible to receive confirmation from the Institution for the settlement of funds on the creditor account or even the debtor's. If this is important for your use case, Yapily recommends using AIS services to monitor the account balance and transactions as a means of confirming settlement.

When building logic to monitor the payment status, Yapily recommends using Exponential Backoff based on the expected settlement of the payment (considering the timings aforementioned, and the status limitations described above).

Future Payments

For future dated payments (ie. Scheduled, Periodic, or Bulk Payments) the Open Banking regulatory bodies (ie. OBIE, Berling Group) do not mandate that banks provide the means to check the processing or execution status. It is common for the bank to only provide the initiation status of the payment.

What does this mean for you? You do not have the same visibility of whether a future dated payment settled as you do with single payments through Open Banking APIs.

It is also possible for the user to cancel a future dated payment by going directly to the bank.

The only way to confirm that a future dated payment created through Open Banking had settled would be to verify the payment on the recipient’s account transaction list.