Tutorial: Get account and transaction data

Introduction

This tutorial explains how to access account and transaction information in the UK with the Modelo Sandbox.

Note: All requests made to the Yapily API require basic authentication.

Overview of steps

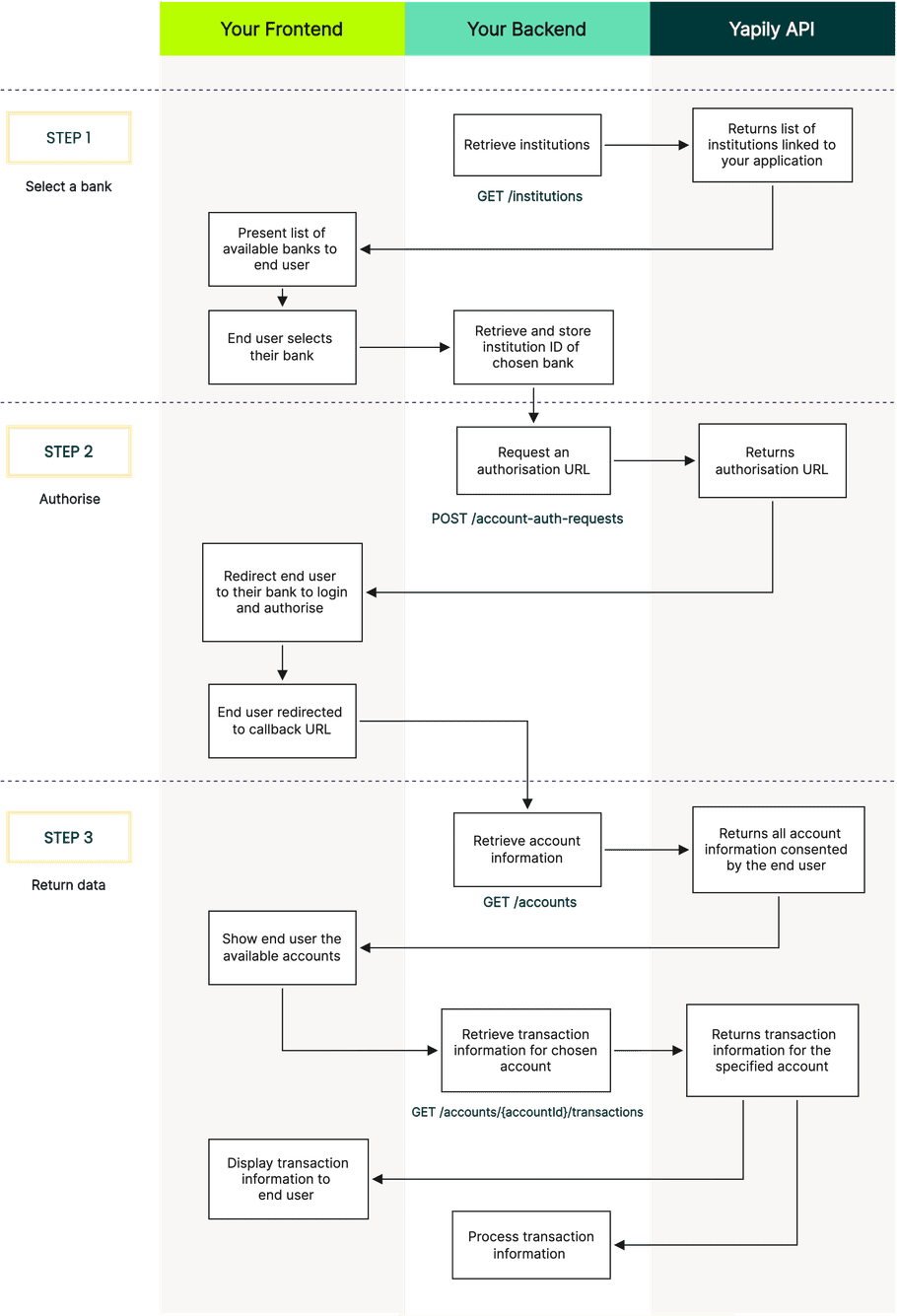

The following diagram illustrates how to access account and transaction information in the UK:

1. Select bank

To find which banks support accessing account and transaction information use GET institutions to retrieve the list of your supported institutions.

Request:

curl -L -X GET 'https://api.yapily.com/institutions' \

-u 'APPLICATION_KEY:APPLICATION_SECRET'Response:

{

"meta": {

"tracingId": "acbb76db4ab8f4ac7f039d000456c13f",

"count": 1

},

"data": [

{

"id": "modelo-sandbox",

"name": "Modelo Sandbox",

"fullName": "Modelo Sandbox",

"countries": [

{

"displayName": "United Kingdom",

"countryCode2": "GB"

}

],

"environmentType": "SANDBOX",

"credentialsType": "OPEN_BANKING_UK_AUTO",

"media": [

{

"source": "https://images.yapily.com/image/ce2bfdbf-1ae2-4919-ab7b-e8b3d5e93b36?size=0",

"type": "icon"

},

{

"source": "https://images.yapily.com/image/ca502f24-d6df-4785-b4b8-1034b100af77?size=0",

"type": "logo"

}

],

"features": [

"INITIATE_ACCOUNT_REQUEST",

"ACCOUNT_REQUEST_DETAILS",

"EXISTING_PAYMENTS_DETAILS",

"ACCOUNT_BALANCES",

"CREATE_BULK_PAYMENT",

"ACCOUNT_PERIODIC_PAYMENTS",

"ACCOUNT_STATEMENTS",

"INITIATE_BULK_PAYMENT",

"ACCOUNT_STATEMENT",

"ACCOUNT",

"INITIATE_DOMESTIC_PERIODIC_PAYMENT",

"INITIATE_SINGLE_PAYMENT_SORTCODE",

"ACCOUNT_DIRECT_DEBITS",

"ACCOUNTS",

"ACCOUNT_TRANSACTIONS",

"EXISTING_PAYMENT_INITIATION_DETAILS",

"CREATE_DOMESTIC_SINGLE_PAYMENT",

"INITIATE_DOMESTIC_SINGLE_PAYMENT",

"ACCOUNT_STATEMENT_FILE",

"CREATE_INTERNATIONAL_SINGLE_PAYMENT",

"IDENTITY",

"CREATE_DOMESTIC_SCHEDULED_PAYMENT",

"INITIATE_DOMESTIC_SCHEDULED_PAYMENT",

"CREATE_SINGLE_PAYMENT_SORTCODE",

"ACCOUNT_TRANSACTIONS_WITH_MERCHANT",

"INITIATE_INTERNATIONAL_SINGLE_PAYMENT",

"PERIODIC_PAYMENT_FREQUENCY_EXTENDED",

"ACCOUNT_SCHEDULED_PAYMENTS",

"CREATE_DOMESTIC_PERIODIC_PAYMENT"

]

}

]

}Filter the list for all institutions that support the ACCOUNTS and ACCOUNT_TRANSACTIONS features. Then display these institutions in your application so the user can select which bank to share their account information from.

Once the user selects a bank, store the id of the institution to use in step 2.

2. Authorise

note

This example uses a single redirect flow using a callback URL.

Execute create account authorisation, including the institution ID and your callback URL.

Request:

curl -L -X POST 'https://api.yapily.com/account-auth-requests' \

-H 'Content-Type: application/json' \

-u 'APPLICATION_KEY:APPLICATION_SECRET' \

-d '{

"applicationUserId": "account-data-and-transactions-tutorial",

"institutionId": "modelo-sandbox",

"callback": "https://display-parameters.com/"

}'Response:

{

"meta": {

"tracingId": "ceab45e96f852afdb59ec8eaf8f93594"

},

"data": {

"id": "979f8a58-c955-46b5-b25d-bdc447c28a80",

"userUuid": "c78035e1-3140-44f7-9539-527785069356",

"applicationUserId": "account-data-and-transactions-tutorial",

"institutionId": "modelo-sandbox",

"status": "AWAITING_AUTHORIZATION",

"createdAt": "2021-03-04T11:05:17.234Z",

"featureScope": [

"ACCOUNT_STATEMENT_FILE",

"ACCOUNT_STATEMENTS",

"ACCOUNT_BALANCES",

"ACCOUNT_SCHEDULED_PAYMENTS",

"ACCOUNT_STATEMENT",

"ACCOUNT_TRANSACTIONS_WITH_MERCHANT",

"ACCOUNT_TRANSACTIONS",

"ACCOUNT_DIRECT_DEBITS",

"IDENTITY",

"ACCOUNT",

"ACCOUNTS",

"ACCOUNT_PERIODIC_PAYMENTS"

],

"state": "e539228113de43b3a3d4c3b9944620d3",

"institutionConsentId": "aac-74e55df8-a673-48b4-b8ae-3e8d0e45080f",

"authorisationUrl": "{authorisationUrl}",

"qrCodeUrl": "https://images.yapily.com/image/d4113d96-9d6c-4e69-a840-2e327cff1b1d/1614855917?size=0"

}

}Redirect the user to the authorisationUrl returned in the response.

The user is then asked to login and authorise the account sharing request with their bank. The Modelo sandbox credentials are: mits / mits.

Upon completion, the user is redirected back to the callback URL supplied in the request. In this example, the callback is https://display-parameters.com/ which displays the parameters returned with the redirect.

Store the consentToken to use when accessing account information in step 3. The featureScope array defines the account features you'll be able to access for each account the user authorises.

Note: Access to the user's account information is for a maximum of 90 days by default before requiring re-authorisation from the user.

3. Return data

Get accounts

Retrieve account information, specifying the consentToken in the header.

Request:

curl -L -X GET 'https://api.yapily.com/accounts' \

-H 'Consent: {consentToken}' \

-u 'APPLICATION_KEY:APPLICATION_SECRET'Response:

{

"meta": {

"tracingId": "14df65068fd38689b392ad39602143cb",

"count": 1

},

"data": [

{

"id": "700004000000000000000007",

"type": "Personal - Current",

"balance": -99765867307.74,

"currency": "GBP",

"usageType": "PERSONAL",

"accountType": "CURRENT",

"nickname": "xxxx0009",

"accountNames": [

{

"name": "Mr. Mitsuhirato"

}

],

"accountIdentifications": [

{

"type": "PAN",

"identification": "1234000000000001"

}

],

"accountBalances": [

{

"type": "EXPECTED",

"dateTime": "2021-03-04T11:08:39.291Z",

"balanceAmount": {

"amount": -99765867307.74,

"currency": "GBP"

},

"creditLineIncluded": false,

"creditLines": []

}

]

}

]

}The response returns an array of account objects for each account the user has provided consent to share information from. The response from every institution is normalised so you can handle the data consistently.

Get transactions

Display the available accounts to the end user so they can select which account to get transaction data for. Once selected, store the account id.

Get account transactions for a specified account by including the account id in the path and the consentToken in the header.

Request:

curl -L -X GET 'https://api.yapily.com/accounts/{accountId}/transactions' \

-H 'Consent: {consentToken}' \

-u 'APPLICATION_KEY:APPLICATION_SECRET'Response:

{

"meta": {

"tracingId": "0d9835a9c83204f8c0607ddfef961bab",

"count": 760,

"pagination": {

"totalCount": 760,

"self": {

"limit": 1000,

"sort": "-date",

"offset": 0

}

}

},

"data": [

{

"id": "15f5b8b3-d8ca-422a-af4e-2538546788e8",

"date": "2021-02-26T11:07:41.79Z",

"bookingDateTime": "2021-02-26T11:07:41.79Z",

"valueDateTime": "2021-02-26T11:07:41.79Z",

"status": "BOOKED",

"amount": -0.99,

"currency": "GBP",

"transactionAmount": {

"amount": -0.99,

"currency": "GBP"

},

"reference": "7",

"description": "Debit for Payment Id: sdp-1-58718033-969e-4941-832b-3ad7b76c3e71",

"transactionInformation": [

"Debit for Payment Id: sdp-1-58718033-969e-4941-832b-3ad7b76c3e71"

],

"isoBankTransactionCode": {

"domainCode": {

"code": "PMNT",

"name": "Payments"

},

"familyCode": {

"code": "ICDT",

"name": "Issued Credit Transfers"

},

"subFamilyCode": {

"code": "DMCT",

"name": "Domestic Credit Transfer"

}

},

"proprietaryBankTransactionCode": {

"code": "PMT",

"issuer": "modelo-sandbox"

},

"balance": {

"type": "CLOSING_AVAILABLE",

"balanceAmount": {

"amount": 99765867307.74,

"currency": "GBP"

}

},

"enrichment": {

"transactionHash": {

"hash": "54be0baf91aaa732cd8b6bacc6396042.1"

}

}

},

...

],

"links": {

"self": "https://api.yapily.com/accounts/700004000000000000000007/transactions?from&before&limit=1000&sort=-date&offset=0&cursor"

}

}The response returns an array of transaction objects for the specified account.

You can then display the transaction information to the end user or process the data internally depending on your use-case.

Note: By default, Yapily limits the results to the most recent 1000 transactions. See pagination for more information on how to manage transaction responses that contain more than 1000 transactions.